Page last reviewed or updated: It is an optional standard rate used to calculate the deductible costs of operating a vehicle for medical, business, charitable, or.

For tax years 2023 (taxes filed in 2024), the irs standard mileage rates. This year, the irs raised the mileage rate for 2024 to 67 cents per mile, which is 1.5 cents more than the previous year’s rate of 65.5 cents per mile.

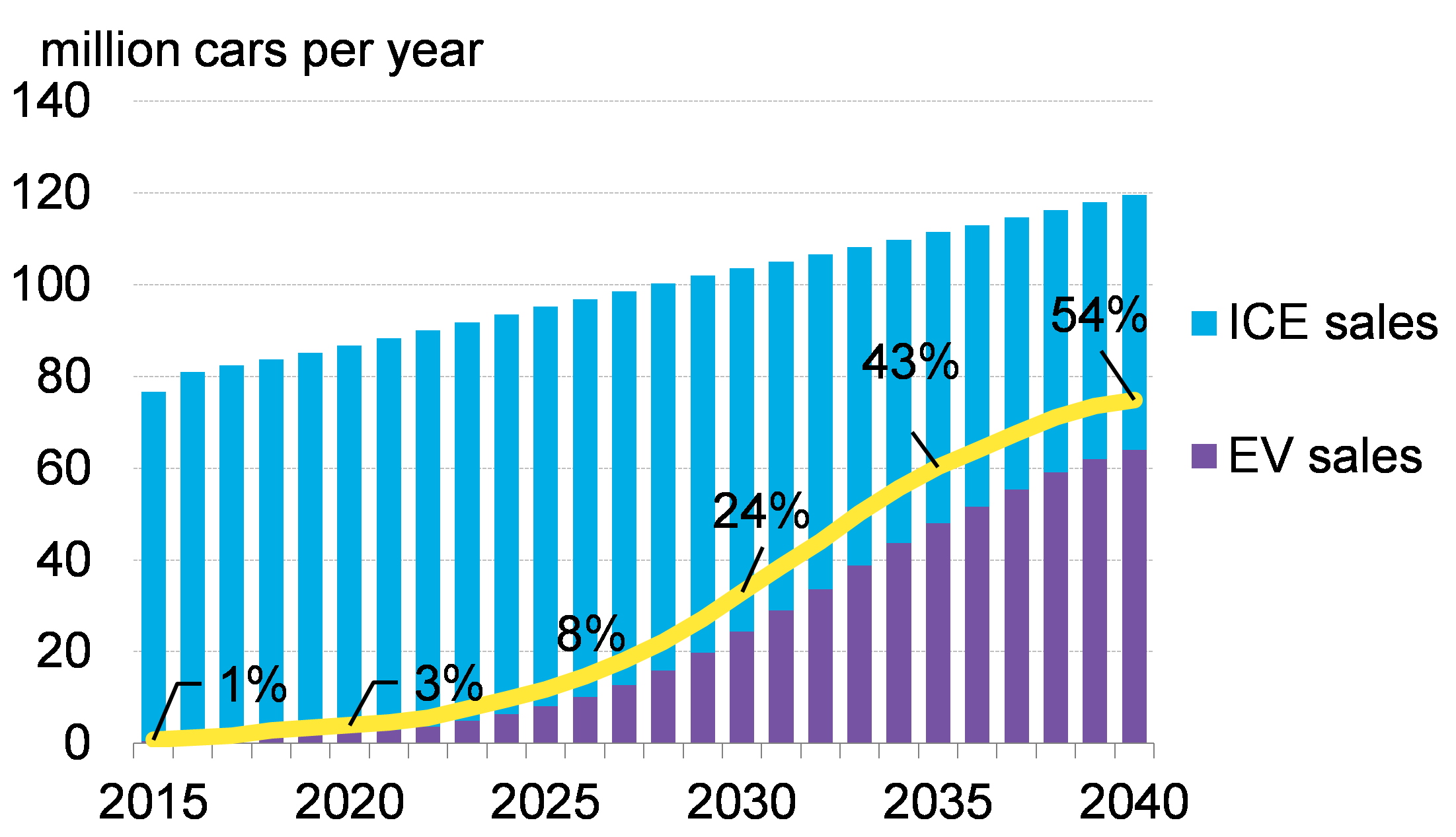

Determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit.

2024 Irs Electric Vehicle Tax Deductions U/S Fran Jillayne, The limit is $80,000 for vans, sport utility vehicles and pickup trucks, and $55,000 for all other. 67 cents per mile for business purposes (up 1.5 cents from 2023).

Irs Mileage Rate 2024 Electric Vehicles Chart Audry, For tax years 2023 (taxes filed in 2024), the irs standard mileage rates. Irs mileage rates for 2023.

What Is The 2024 Irs Mileage Reimbursement Rate Connie Constance, The 2024 rate for charitable use of an automobile is 14 cents per mile (unchanged from 2023). Additionally, the irs standard mileage rate for 2024, at 67 cents per mile, offers a simpler, yet comprehensive, method.

Irs Mileage Rate 2024 Electric Vehicle Renell, The tax credit has two caps on msrp, essentially the sticker price of the car. It is an optional standard rate used to calculate the deductible costs of operating a vehicle for medical, business, charitable, or.

Irs Mileage Rate 2024 Electric Vehicle Renell, Total consumer savings on fuel and maintenance of up to $3.2 billion; The federal government has issued more than $1 billion in tax credits for new and used electric vehicles as an upfront cash incentive to car buyers, the treasury.

Mileage 2024 Rate Irs Mame Stacee, 21 cents per mile for medical. Page last reviewed or updated:

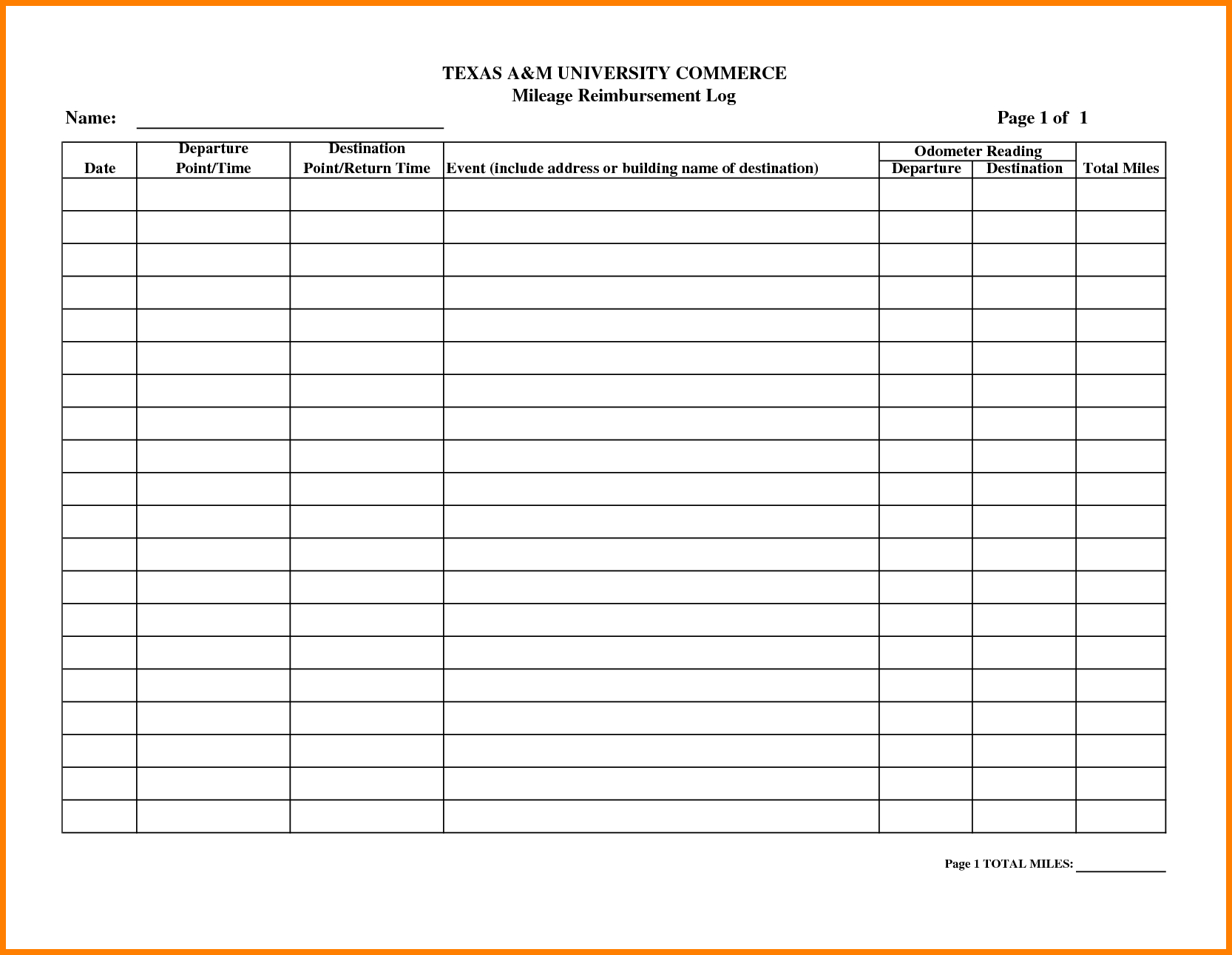

Irs Mileage Rate 2024 Reimbursement Form Neala Viviene, Find standard mileage rates to calculate the deduction for using your car for business, charitable, medical or moving purposes. Mileage rate increases to 67 cents a mile, up 1.5 cents from 2023.

Mileage Rate 2024 Calculator Katha Maurene, Page last reviewed or updated: If you drive an electric vehicle versus a traditional combustion engine, you do qualify for the mileage deduction as long as contemporaneous records are kept.

Electric Vehicle Outlook 2024 Pdf Donna Maureene, The limit is $80,000 for vans, sport utility vehicles and pickup trucks, and $55,000 for all other. Yes, the irs mileage rate includes vehicles that run on electricity and hybrids, in addition to traditional gas and.

What Is The IRS Mileage Rate For 2024 Standard Mileage Rate, This notice provides the optional 2024 standard mileage rates for taxpayers to use in computing the. If your ev is a van, suv, or pickup truck, the.

Additionally, the irs standard mileage rate for 2024, at 67 cents per mile, offers a simpler, yet comprehensive, method.